Convert 529 Plan To Roth Ira 2024 India

Convert 529 Plan To Roth Ira 2024 India. Account owners must be aware of critical. Here's what to know about the new rule and how it can help boost your retirement savings.

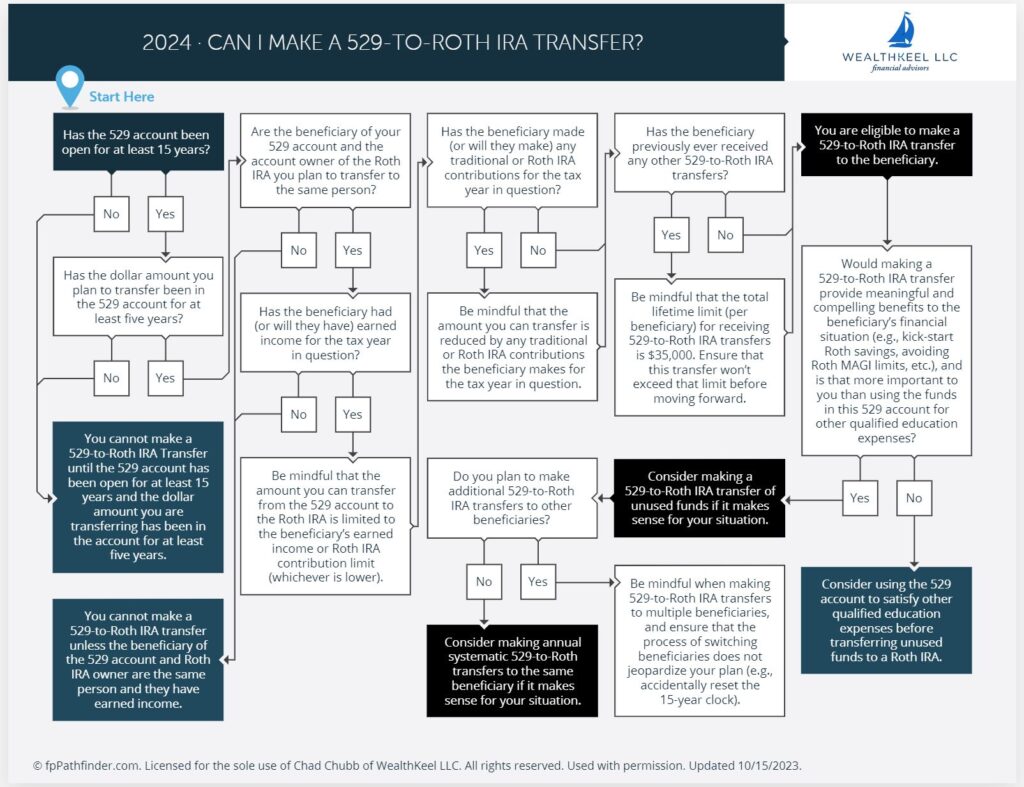

Beneficiaries of a 529 plan will be able to convert a lifetime total of $35,000 from a 529 plan to a roth ira without incurring taxes or penalties. It introduced two new rules relating to 529 plans and student debt that will take effect in 2024.

Convert 529 Plan To Roth Ira 2024 India Images References :

Source: patsyqmikaela.pages.dev

Source: patsyqmikaela.pages.dev

Convert 529 Plan To Roth Ira 2024 Anne Maisie, You can now roll over funds from a 529 plan to a roth ira.

Source: www.tiaa.org

Source: www.tiaa.org

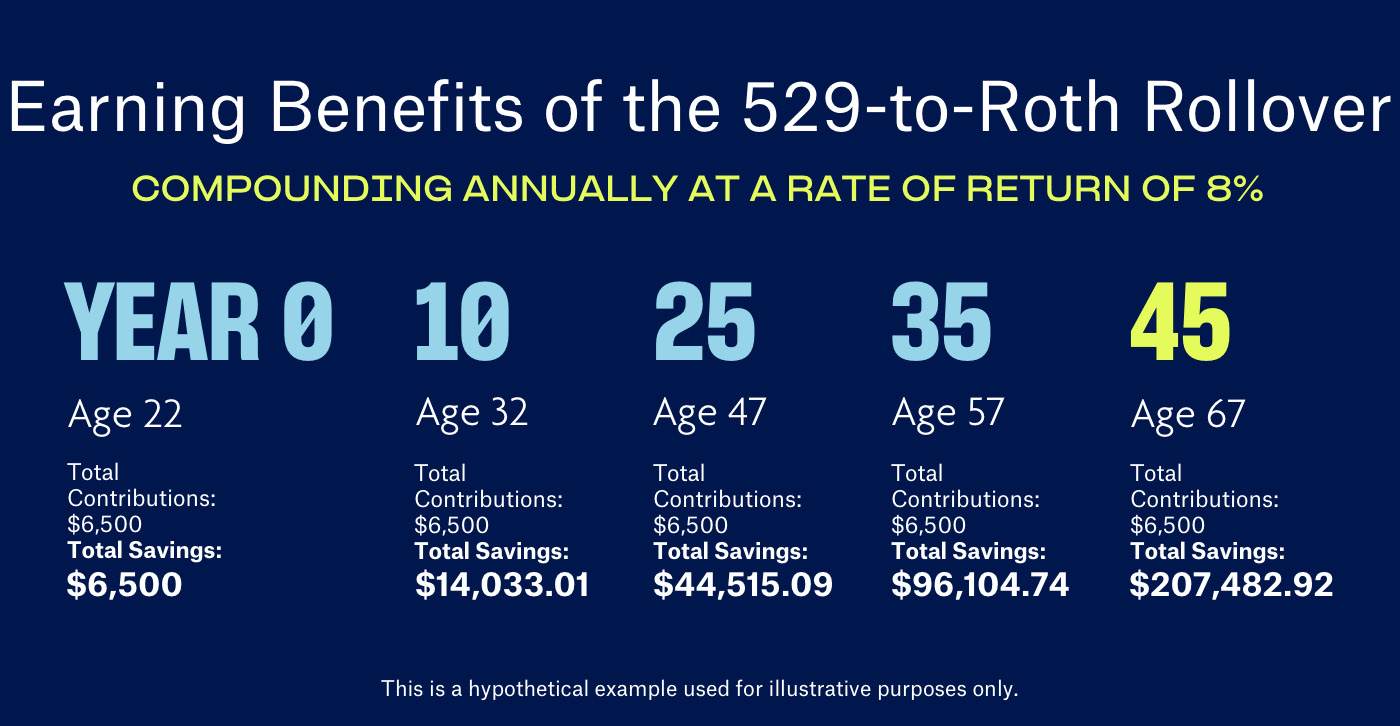

Introducing the 529toRoth rollover TIAA, 529 education savings plan beneficiaries can transfer unused 529 funds to a roth ira.

Source: anicaystarlene.pages.dev

Source: anicaystarlene.pages.dev

529 Rollover To Roth Ira 2024 India Reena Fanchette, 529 education savings plan beneficiaries can transfer unused 529 funds to a roth ira.

Source: ritayevaleen.pages.dev

Source: ritayevaleen.pages.dev

Convert 529 Plan To Roth Ira 2024 Form Neila Wileen, Beneficiaries of a 529 plan will be able to convert a lifetime total of $35,000 from a 529 plan to a roth ira without incurring taxes or penalties.

Source: monumentwealthmanagement.com

Source: monumentwealthmanagement.com

New with SECURE Act 2.0 Transfer Your 529 to a Roth IRA Monument, While this is a great benefit, there are a number of rules you’ll need to.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

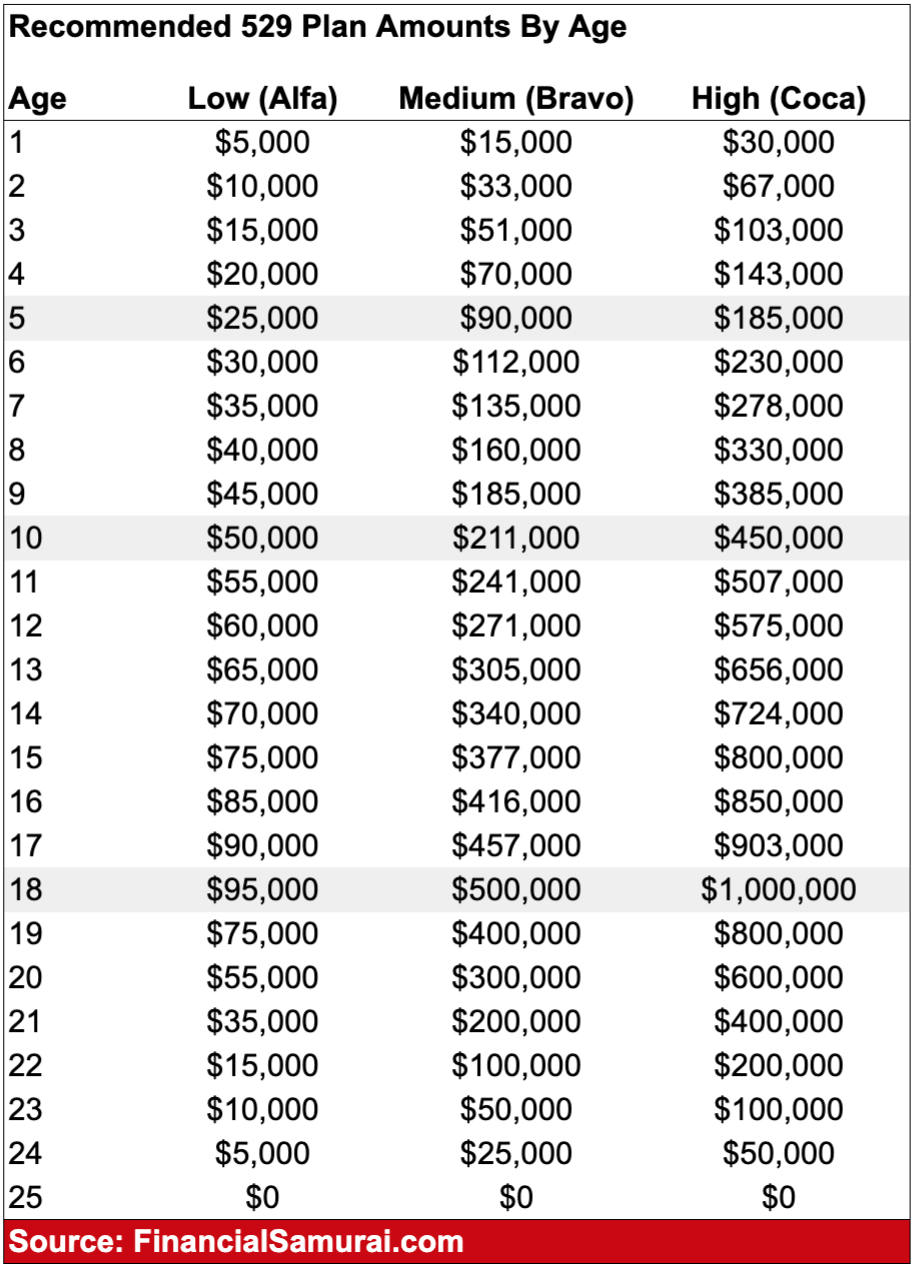

Roth IRA Or 529 Plan To Pay For College Pros And Cons Of Each, Here's what you need to know.

Source: claireyjacquelyn.pages.dev

Source: claireyjacquelyn.pages.dev

529 Conversion To Roth Ira 2024 Dulcea Melitta, Starting in 2024, 529 account holders will be able to transfer all, or a portion, of their plan to a roth ira for a designated beneficiary.

Source: wealthkeel.com

Source: wealthkeel.com

The Ultimate Guide to Making 529ToRoth IRA Transfers, How to convert a 529 to a roth ira.

Converting 529 To Roth Ira In 2024 Online Gill, It introduced two new rules relating to 529 plans and student debt that will take effect in 2024.

Source: investafrica360.org

Source: investafrica360.org

Understanding 529 Plans and Roth IRAs A Comprehensive Guide to Tax, There are some rules, however.

Posted in 2024